You are leaving Marsh Japan's website. Marsh Japan has provided this link for your convenience, but assumes no responsibility for the content, links, privacy policy or security policy of the website.

Do you wish to leave our website?

GLTD

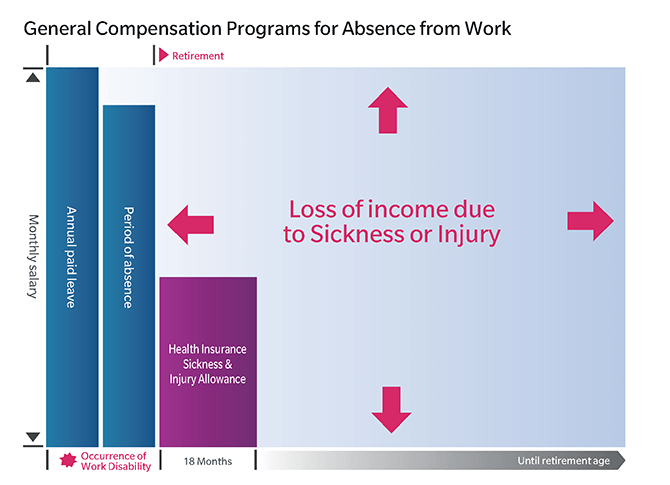

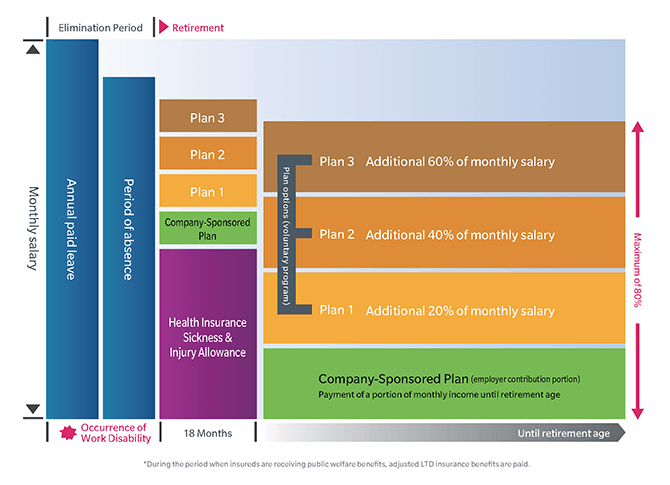

Long-term disability (LTD) is a program that provides compensation for income if an employee is unable to work because of illness or injury. LTD has been introduced by many companies in Europe and the United States, and introduction has increased, primarily among publicly-listed companies, in Japan since its introduction in 1994.

If an employee becomes unable to work because of illness or injury, the lost income can increase to massive amounts of up to 10 million yen over several years and even 100 million yen if the employee is permanently unable to work and income ceases. Medical expenses during hospitalization are covered by hospitalization insurance, but such insurance does not pay benefits for home-based care). Currently, there are few programs for insurance products that provide adequate living expenses in response to the risk that an employee will become unable to work.

For companies and human resource divisions, effective human resource evaluation program operation requires the indication of appropriate consideration in cases where employees take leave or retire because of illness or injury. In addition, even if an employee returns to work before he or she is fully ready to do so, allocation of work tasks in the workplace can be difficult.

LTD Program is attracting attention as a solution to these issues and is becoming established as an essential corporate benefits program. LTD programs are closely related to personnel programs, and as a result, specialized knowledge is required for planning, introduction, and operation. Marsh, which has experience introducing many LTD programs in Japan, believes that the four keys to the success of an LTD program are that employees play a central role in operation, that many employees participate, that the program serve as a substitute for existing programs, and that management be performed according to global standards.

Features of the LTD Program

Maximum benefit payment period is until retirement age

Payment of benefits begins when an employee is unable to work for a period longer than the exclusion period and income is supplemented until the employee recovers from the illness or injury and is able to return to work until the employee reaches retirement age.

Benefits continue even after return to work (or reemployment)

If an employee has a residual disability or requires ongoing treatment even after recovery and the employee is unable to perform the same work as previously and the decrease in income exceeds 20%, insurance benefits continue to be paid according to the rate of reduction in income.

Benefits continue even after retirement

If an employee retires, insurance benefits continue to be paid during the period when income is reduced as a result of illness or injury.

Broad coverage

Benefits are paid for any illness (including mental illness) or injury that prevents the employee from working, whether occupational or non-occupational and whether incurred in Japan or overseas.