You are leaving Marsh Broker Japan's website. Marsh Broker Japan has provided this link for your convenience, but assumes no responsibility for the content, links, privacy policy or security policy of the website.

Do you wish to leave our website?

Global Insurance Market Index - 2020 Q1

Global Commercial Insurance Pricing Up 14% in First Quarter

- Global commercial insurance pricing increased for the tenth consecutive quarter in the first quarter of 2020, according to Marsh's quarterly Global Insurance Market Index, a proprietary measure of global commercial insurance premium pricing change at renewal, representing the world's major insurance markets and comprising nearly 90% of Marsh's premium.

- The increase, the largest since the index was launched in 2012, comes despite the minimal impact of the COVID-19 global pandemic on pricing in the quarter. Average price increases were driven principally by increases in property insurance and financial and professional lines.

- Globally, pricing for property risks increased 15%; financial and professional lines rose nearly 26%; and casualty increased 5%.

- Composite pricing in the first quarter increased in all geographic regions for the sixth consecutive quarter.

- The US (14%), UK (21%), and Pacific (23%) regions all experienced double-digit pricing increases. As well as increases in property pricing, much of the increase, was driven by increases in financial and professional lines, and directors and officers (D&O) rates in particular.

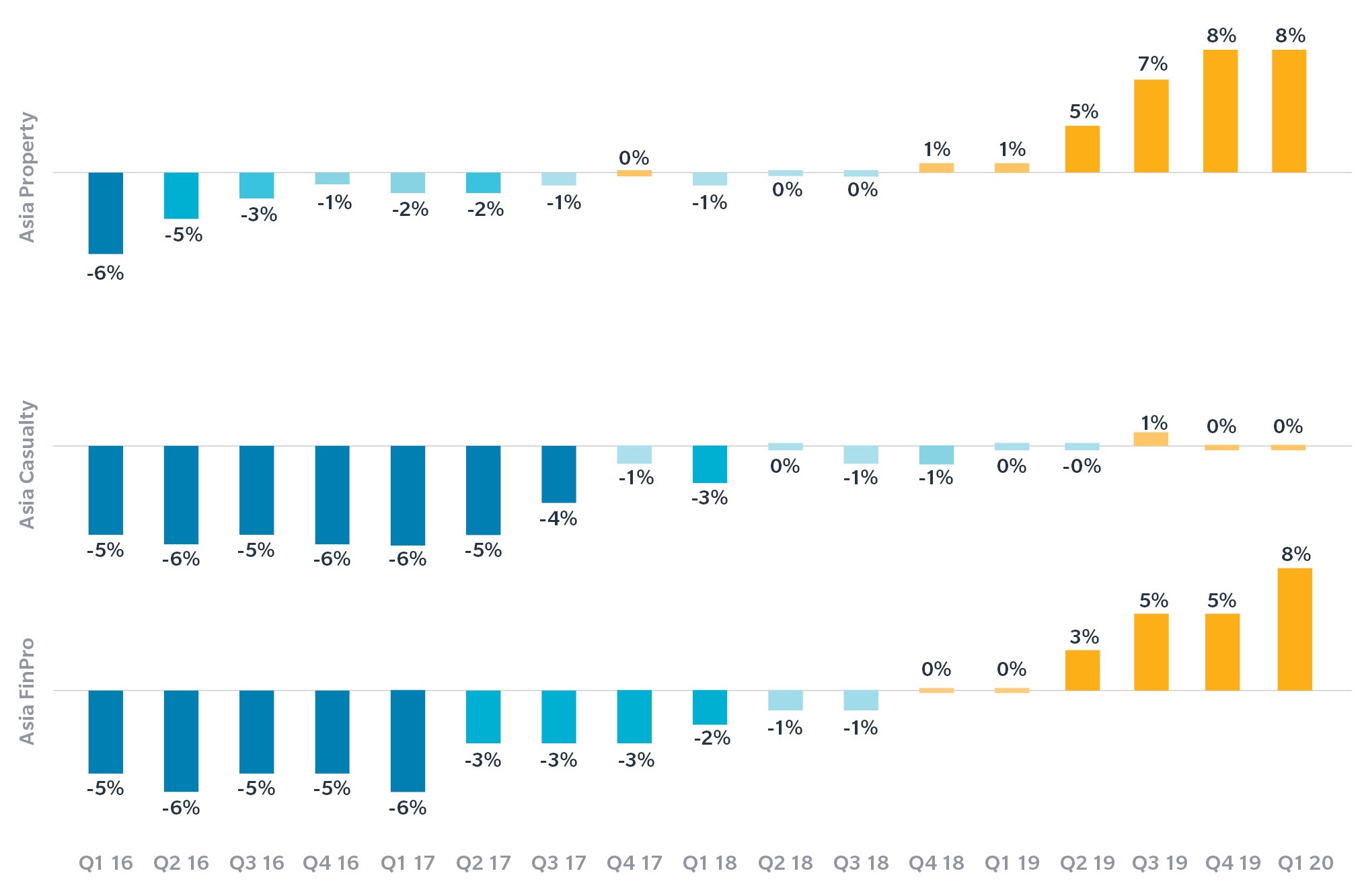

- Asia region experienced 6% pricing increase, mainly driven by increases in property, directors and offers (D&O), financial and professional lines.

Use the mouse wheel to zoom in and out; use mouse drag to pan to a specific period of time.

Asia Perspectives

Asia region experienced 6% pricing increase, mainly driven by increases in property, directors and offers (D&O), financial and professional lines.

Asia Property

Property pricing rose 8% across the region, although we have witnessed countries across the region reacting at different speeds throughout the quarter.

- Clients seeking large Nat Cat Limits or have complex risks have seen outsized increases above the average in Q1. We have observed an acceleration in this space compared to past quarters. In addition, the lack of competition is contributing to pricing increase as well.

- Underwriting authority remains in the region but global leadership is interrogating the underwriting decisions in more detail, adding to the response times. The increase is seen to be in relation to exposures related to and affected by Covid-19.

- Distinct two-track market with international insurers driving increased rating pressure through their portfolio to a far greater extent compared to local insurers.

- Indigenous capacity for the small and medium sized accounts still represents the most attractive solution to many cost-conscious clients.

Asia Casualty

Casualty pricing was flat throughout Q1, largely a result of a continued benign claims environment.

- Complex product liability and recall policies present the most challenging accounts, with limited competition. This is also a result of international capacity withdrawals.

- Broadly, casualty pricing and capacity will be affected by the international insurers’ macro response to deteriorating profitability. Rating adequacy and reduced exposure management will be the drivers for casualty in Asia.

Asia FINPRO

Financial and professional liability pricing rose 8% across the quarter. We have seen an acceleration of this rise in the later part of Q1 with many segments seeing greater increases than the overall average. This is the largest increase observed in several years and the fourth consecutive quarter of increases.

- Pricing increased across the Asia region with a greater focus on D&O, Financial Institution lines, and Commercial Crime.

- Considerable underwriting scrutiny is being applied to D&O and Medical Malpractice, especially for risks with any perceived COVID exposures (both direct and indirect). The underwriting response times have also slowed considerably with an increasing need for regional and global referrals.

- Most international insurers on FINPRO lines have also turned their attention to reducing “per risk” capacity. This follows several years of typically underwriting close to their maximum line sizes.

- In general, we have seen a marked reduction in appetite to compete, especially on risks with claims or notification activity, where previously some insurers were prepared to be opportunistic.