COVID-19 Pandemic Adds to Rate Pressure for D&O Buyers

As risks emerge and evolve, the COVID-19 pandemic continues to challenge organizations — and their directors and officers. Tasked with making difficult decisions to protect and promote their companies’ viability, directors and officers are increasingly exposed to litigation and financial loss during this time of transition, which for many is also a time of distress.

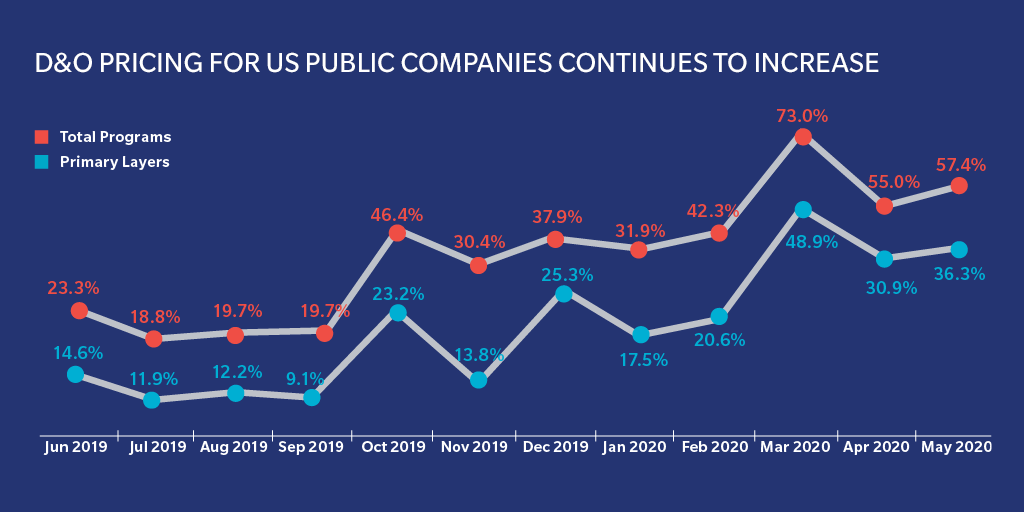

Since 2019, directors and officers liability (D&O) insurance pricing for US public companies has increased by double digits — and grown larger each quarter. Although the current market upswing dates back to the third quarter of 2018, the pace of change — exacerbated by the pandemic — is now accelerating.

While the ongoing pandemic is currently a top priority and concern for organizations and insurers, its full impact on D&O pricing remains to be seen. Other trends are further complicating market conditions, driving a persistent deterioration of loss activity — and prompting insurers to continue to increase rates as they seek a return to profitability.

Rate Increases Accelerating

In the first quarter of 2020, total program pricing for US public companies increased 44%, while primary rates increased 26%. Total pricing increased for 95% of Marsh clients renewing their D&O insurance programs in the first quarter; primary pricing increased for 89% of clients.

Monthly figures show an even sharper upward trajectory (see Figure 1). Primary rates increased 30.9% in April and 36.3% in May. These figures, however, do not include data for the many companies renewing during those months that increased their retentions by more than 50%. If those companies are added, the primary rate increases jump to 44.0% in April and 47.7% in May.

Management liability insurers continue to focus on profitability rather than top-line growth. As D&O losses have increased in frequency and severity, insurers have insisted that rates continue to materially increase. This pressure for buyers has manifested in primary, excess, and — more recently — Side-A premiums, which have been driven up by a steady influx of derivative claims and some large settlements.

Marsh will continue to closely monitor market trends on a monthly basis and advise clients on the state of both the D&O and overall commercial insurance marketplace. Buyers should be mindful that current unfavorable conditions -- while exacerbated by the COVID-19 pandemic recently and in the near future -- are largely the result of broader trends that have been developing for some time.

COVID-19 Lawsuits Expected to Affect Pricing and Terms

Although COVID-19 exclusions are not widespread to date, some insurers are introducing insolvency exclusions and — in some circumstances — requiring that buyers sign warranty letters. Several D&O lawsuits related to the pandemic have already been filed, including both securities class actions and shareholder derivative actions. Insurers are bracing for more litigation in the coming months, which could continue to affect pricing as well as terms and conditions.

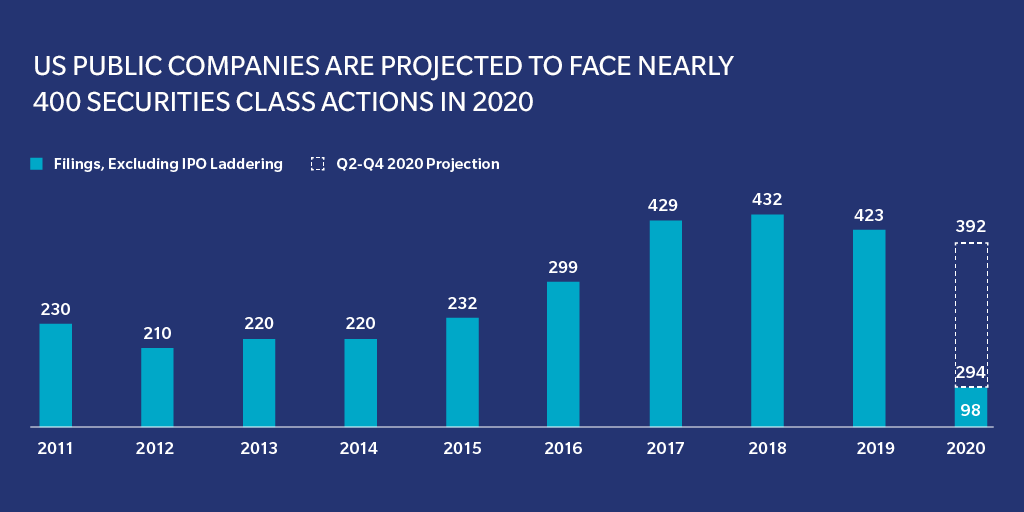

Beyond COVID-19, securities litigation trends remain worrying to insurers: 98 class-action suits were filed in the first quarter, according to NERA Economic Consulting, putting 2020 on pace for 392 total filings (see Figure 2). That would represent a modest decline from the elevated activity seen in the last three calendar years.

While capacity remains stable, insurers are judiciously managing it and taking tougher positions on policy language and claims. Substantial price increases, meanwhile, have prompted some companies to restructure their programs, including purchasing lower limits. Discussions about alternative risk solutions — for example, D&O trusts or captives — that began before the pandemic are also becoming more common, although to date these alternatives are not being widely implemented.

Private Company D&O Market Becoming Less Favorable

Though generally not as steep as the hike seen in the public company marketplace, pricing is also increasing for private companies. In the first quarter of 2020, average pricing for primary layers increased 8.5%, while total program pricing increased 8.9%. Some small pockets of buyers saw pricing increase by 50% or more.

Growing employment practices liability (EPL) losses are increasingly eroding the profitability of combined D&O/EPL programs. Insurers are also bracing for more medium to high severity D&O claims as private companies fall into distress or file for bankruptcy amid the economic downturn.

Meanwhile, unicorns — privately held startups valued at more than $1 billion — are seeing especially difficult conditions, largely because their valuations are not based on financial metrics. This increases the odds of investor litigation.

Private companies have historically provided underwriters with annual financial statements during renewals, but should consider providing more information going forward. Submissions should also be followed up with presentations to underwriters to answer any questions about company performance, key contracts, and future business plans.

EPL Market Readies for Spike in Claims

Though relatively modest, EPL price increases in the first quarter were the largest observed in two years, and come during an already difficult time for the market. Pricing on primary layers increased 5.3% in the first quarter, while total program pricing increased 6.3%.

Still contending with elevated claims activity spurred by the #MeToo movement, COVID-19 has added to underwriters’ concerns. While a number of pandemic-driven EPL and wage and hour claims have been filed so far, many more are expected later in 2020. Retaliation and whistleblower claims are of chief concern to insurers, but employers will also likely face various discrimination and wage and hour claims related to workforce reduction measures, as well as class-action exposures under various labor laws.

Despite earlier suggestions that EPL underwriters would introduce COVID-19 exclusions en masse, relatively few have materialized to date. The pandemic, however, has coincided with more insurers considering the introduction of broad exclusions related to Illinois’ Biometric Information Privacy Act and other privacy statutes.

Meanwhile, coverage enhancements and broader policy language are generally unobtainable. And, as in the D&O market, EPL underwriters are asking buyers more pointed questions, and — in some cases — seeking to reduce capacity and increase retentions for employers.

As underwriters’ concerns related to COVID-19 mount, employers can better position themselves for favorable renewal outcomes by highlighting loss control efforts. Among other actions, employers should consider:

- Designating a person or task force to stay current on evolving laws and regulations.

- Consulting with in-house or outside legal counsel before making critical employment decisions.

- Reviewing and reassessing prior decisions — which may, in retrospect, seem hasty — regarding workforce reduction measures and making corrections where possible.

Employers should also note that while many laws and regulations set the minimum standards they must meet, they should strive to lead with compassion. Being more understanding, permissive, and flexible with employees — within the bounds of the law and business needs — will be appreciated by both workforces and underwriters.Private Companies Brace for Less Favorable Market.

Renewals Require Increased Preparation

Pricing increases and more stringent underwriting will likely require buyers with upcoming renewals to make difficult decisions about their D&O programs — some may be forced to choose between higher limits and broader coverage or saving money at a time when cash flow may be critical. Considering the potential difficulty of these decisions, risk professionals should begin preparations early and ahead of underwriting meetings to clearly define renewal priorities and strategies.

Buyers should be ready for more questions from underwriters. Among other topics, insurers will likely ask about the anticipated direct and indirect impacts of COVID-19 on organizations’ continuity plans and reporting chains, up to the board level. Being open and communicative and answering questions in detail can better position buyers to mitigate the magnitude of pricing increases and secure more favorable terms and conditions.

At the same time, buyers must avoid focusing solely on COVID-19 at the expense of other priorities for underwriters. Underwriting submissions should address other potential sources of risk, as is typically done in any other renewal.

While long-term relationships with insurers can be useful, buyers — especially those with significant exposures — should prepare to market their programs. As they do so, it’s important that they differentiate their risks and highlight superior loss control efforts. Data can be useful in this process, but while numbers can help underwriters better assess an organization’s health, qualitative information — regarding the “tone at the top,” the accessibility of key executives, procedures and protocols in place for unexpected events, and more — can provide a more complete and accurate picture. When changing or adding insurers, it’s also important to carefully analyze language in warranty letters — in consultation with brokers — to ensure they are not overly broad.