Marsh JLT Specialty is pleased to issue the first Energy and Power Insurance Newsletter of 2021 considering the trends over the final quarter of 2020.

The energy and power insurance market provides solutions for companies operating within upstream, downstream, casualty, traditional power, and renewable energy. The articles consider the nuances and trends being experienced across the various sectors.

State of the Market Overview

State of the Market Overview

Generally, all energy and power insurance sectors continue to experience contracting capacity, increasing rates, and tightening of conditions.

The exception is the upstream sector that continues to lag because of excess capacity remaining for all but a few, very large value projects.

Insurers have some common concerns, which may affect coverage – including COVID-19 or communicable disease exclusions, and restrictions on cyber cover.

Generally, all energy and power sectors continue to experience contracting capacity, increasing rates, and tightening of conditions.

The drivers from the wider insurance sector, and indeed the wider economy, all have an impact on the energy and power sector. Two such drivers are the impact of COVID-19 losses, and the attraction of new capacity to the (re)insurance market.

According to Moody’s, global property and casualty insurance claims from COVID-19 will exceed US $22 billion, but the sector's capitalization is solid, with carriers set to absorb these commercial claims from earnings.

Moody’s noted that COVID-19 claims “remain manageable” with reinsurance mitigating the impact of business interruption claims. In addition, the frequency of personal lies claims reduced during the pandemic.

According to Guy Carpenter data, there has been over US $43.5 billion of capital raises in the insurance/reinsurance sector since the beginning of 2020. This capital has entered the industry looking to take advantage of an improving trading position for insurers. This is a substantial amount of capital, however, the amount is relatively modest in the context of available insurance market capacity.

Energy Property Update

Upstream Energy

Year-end has seen insurers forming a pyramid of attitude towards renewals.

At the base, small businesses (paying below US $250,000 in premium) have continued to experience market tightening as minimum premium amounts continue to come under pressure. Increased management oversight of quotations has further reduced the cost effectiveness with a further impact on capacity.

It is expected that 2021 will accentuate the contrast of upstream energy with other specialty sectors, where increases to date have been much higher.

For midsized companies (paying premium between US $250,000 and US $10 million) who have not experienced claims, lead insurers are on average looking to increase rates by around 5% or more. While average rate increases were 2.5% in the third quarter of 2020, in the fourth quarter of 2020 increases of 7.5% to 10% were more common.

Insurers are still actively looking to provide capacity for larger insureds, and so they have not been subject to the same rating pressure, although reductions on like-for-like programs are rare.

Currently 58 markets make up the core capital deployed across the upstream energy sector. Of these, 32 have capacity of US $100 million or more. The buoyant markets that previously existed in Singapore and Dubai have matured somewhat and are more disciplined in their deployment of capacity.

Around the world, many of the larger carriers have migrated authority back to London.

The most distressed part of the upstream book is the offshore drilling contractor segment. In a sector with fewer insureds, and smaller insured values, there is still the possibility of significant losses.

As a result, there is the potential that rates may increase. This is evident in North America where the sector has experienced average price rises of 10% as well as increased deductibles and coverage constraints.

Similarly, offshore construction is a class that underwriters are wary of — completion of larger projects is increasingly challenging and often requires participation of the oil company’s captive (where available).

In a year where loss activity has been relatively benign, there have been three high profile upstream energy claims in 2020: a fire in an LNG plant in Northern Norway; a US $120 million loss of contract claim in Angola due to a dropped blowout preventer; and a reported US $100 million offshore construction incident in Qatar.

One of the biggest issues currently facing underwriters is the rise in reinsurance costs; for the first time in three years, costs have risen by close to 10% and reinsurers are reducing the amount of cyber protection available.

COVID-19 and cyber losses borne by the large European reinsurers, who fuel the energy market capacities, have reduced treaty competition which is affecting insurers’ cost of capital.

At the same time, the exposure basis is shrinking – there are less wells to insure within the industry, fewer construction projects, and constrained rig activity. As a result, insurers compete to participate on preferred risks and maintain the portfolios they have developed over the last five years.

This has meant that significantly less premium is flowing in the system; it seems inevitable that, at some point, insurers may be forced to respond to the economic transition now occurring in the oil and gas industry.

It is expected that 2021 will accentuate the contrast of upstream energy with other specialty sectors such as onshore property, casualty, directors and officers, hull, and cargo, where increases to date have been much higher.

As confidence in the upstream class reduces, management goodwill from past profits is expected to be tested; environmental, social, and governance (ESG) pressures may intensify this pressure.

Downstream Energy

Customers have been trading through the most challenging times and insurers have continued their focus on rate correction within the sector.

The good news is that global losses have been within expected tolerance levels and are currently trending below US $2 billion. The largest individual losses have fallen between South Korea and South Africa and relate to petrochemical and refining.

New clauses may result in insurers seeking further coverage restrictions, in addition to rate increases, as some conduct more holistic policy wording reviews.

2020 has also seen an active Gulf of Mexico windstorm season. Although claims are now manifesting and escalating from Hurricane Laura, overall energy infrastructure has been only mildly impacted.

Some deterioration of prior year losses are now being realized however, based on industry indicators, 2020 is expected to provide good returns to most downstream and midstream insurers.

During the fourth quarter, increased differentiation from insurers when assessing customers’ risk quality and rating adequacy, coupled with the prior market correction, has reduced rate increases. Nevertheless, average rate increases over the quarter trended on average at 25% on downstream, with the range for midstream continuing to be plus 12.5% to 17.5%.

In addition to the new clauses that are making headlines – being communicable disease, resultant physical damage from cyber events, and business interruption volatility clauses – some lead markets are conducting in-depth reviews of policy wordings.

This may result in further coverage restrictions, in addition to rate increases, being sought by insurers. Nevertheless, one insurer is offering pricing incentives for “clarifications” and “tidy ups” of policy wordings – a positive step as clarity of contract is in the interests of all parties.

Rating deviation has continued between insurers within geographies, and between geographies required to complete major placements. For example, terms are more closely aligned on Asia Pacific and MENA placements that include London market support than North American risks which come to London.

In terms of the 2020 headline clauses, the Lloyd’s Market Association (LMA) has been particularly busy. It has been approximately 18 months since insurers made a serious push towards capping the volatility of business interruption exposures; version 12 of the LMA business interruption volatility clause is now being attached to customers’ policies.

It is necessary to develop such clauses as part of a continuous improvement process, but given there are hybrid versions of each LMA version it can lead to confusion, especially in the event of a loss.

Pandemic pain looks set to continue through the first quarter of 2021.

Nevertheless, it is clear that although midstream earning structures have insulated the sector somewhat, downstream earnings were significantly depressed during the pandemic; many companies have experienced estimated gross earnings for 2021 which are muted in relation to initial 2020 projections.

The business interruption volatility clause has been less of a concern due to impact of the pandemic, but it is expected to become a more important issue as the energy market begins its return to pre-COVID-19 normality and commodity prices rise, especially with earning projections starting from a lower base with an opportunity of higher upside.

The COVID-19 impact saw a variety of communicable disease exclusion clauses introduced, which are now being mandated on policies. Insurers appear to have achieved close to a consensus, and settled on one clause for downstream risks.

We continue to work with markets to address some elements of the language used within the agreed wording to provide increased clarity on intended coverage for non-physical damage events.

For midstream business, an alternative clause can be adopted from a more established clause in the upstream market. Aside from sensitivities on coverage scope, consideration should be given to ensure policy sub limits for expenses incurred as a result of a communicable disease are sufficient to support continuity of operations and the asset integrity that goes with it.

Another “living” clause meriting specific interest relates to resultant physical damage from a cyber event.

This is a different but equally complex issue, as there is debate as to where this specific element of coverage should sit. Customers regard the exposure as forming part of their standard property policy, while the developing cyber market includes it as an element within the cyber scope.

The downstream market has recently shifted to either exclude resultant damage from a cyber event, or provide very limited coverage as a result of excluding malicious acts. The impact of this is that, the traditional cyber market may not be in a position to provide appropriately priced capacity for midsized or larger customers.

To date, there is no substantive evidence of physical damage, fire, or explosion to currently available policy limits which are the result of cyber-attacks on downstream energy facilities. For this reason, downstream insurers will consider including a broader fire and explosion write back within the policy.

There remain additional potential workarounds within the terrorism markets, although the scope of cover varies.

Capacity remains generally adequate for midstream requirements, and we expect appetite to remain strong.

Perhaps the most challenging clause to come out of the LMA recently is a valuation and average clause. The intent of this clause is to ensure declared insurable values fairly represent the actual asset replacement costs, to allow for appropriate rating as well as the correct risk correlation to the estimated or probable maximum loss scenarios.

While it is in the interest of both parties that a fair representation of the values at risk are established, both in assessing the risk transfer and expediting claims payments, there are significant challenges with this clause.

Average clauses are not standard within general property markets, particularly for full value policies. Where they fall down within downstream energy is the multi-locational complexity and the scale of the asset base.

Generally, most customers retain significant risk, both in retention levels and above “first loss” program limits, which are often based on estimated maximum loss calculations. It is in the customer’s interest to ensure values are correct. On the other side, most insurers have engineering capability and a significant database across their entire portfolio to understand the asset value weighting of risks.

Although there remains the possibility that insurers will make an allowance for the cost of an independent valuation out of the premium, the ultimate cost will be borne (directly or indirectly) by the customer.

The fundamental difficulty however is that until the re-valuation is finalized, average applies to the policy, and the process to agree and finalize values can be time consuming. If a loss occurs before valuations are finalized, there is enormous potential for dispute, delay, breaches of lenders’ covenants, and the like.

To add to this, any adjustment to values originally declared at inception resulting from the valuation report applies from policy inception, which should be taken into account if there has been a loss during the intervening time.

Given the relative scale and value of the assets, such premium adjustment can have a significant impact on budgets and cash flows; the clause results in volatility that should be avoided. Fortunately, the vast majority of insurers look for alternative ways to ensure a commercial solution in relation to valuations, but clients and brokers should strongly resist the imposition of this punitive clause, or look to replace the security proposing to impose it.

Where there is underlying substance to these clauses, the 2019 and 2020 market conditions have not always allowed for clients and brokers to look to balance some of the excesses within the clauses, we expect this to change in 2021.

As further capacity enters the sector, these clauses will inevitably find an appropriate balance, which increases the certainty for insureds.

In terms of market conditions in 2021, pandemic pain looks set to continue through the first quarter and, although improving, may remain challenging for customers throughout the remainder of the year.

It should be expected that customers will increase their focus on eliminating speculative cost from their businesses, and this will include finding solutions to mitigate rising insurance premiums.

At this point, there appears to be limited new capital coming to the downstream market, but it is anticipated that a number of insurers may look to release further capacity to take advantage of the pricing increases, and anticipated enhanced returns on their capital.

Insurers may also look to mitigate the significant level of return premium related to adjustments in business interruption values as a result of the COVID-19 induced downturn.

Capacity remains generally adequate for midstream requirements, and we expect appetite to remain strong.

It is also expected that insurers who offer outlying pricing and/or conditions will not achieve a share of programs, as customers will have more choice. There has been a trend for customers to mitigate premium spend by retaining more risk, or by mutualization.

It is notable that additional retentions taken by customers are often in response to mitigating elements of aggressive insurer pricing or restrictions, and they are not looking to make general concessions on retention levels. We expect that the result of this will be a further flattening of the rating increases from the first to second quarter. Midstream clients are expected to experience lower rate increases.

In summary, there remains material uncertainty and obstacles in 2021, but there is significant potential to find a sustainable balance that provides stability in the marketplace.

Power

Traditional

At the end of 2020, the market remained challenging.

Restructuring of programs is now commonplace, with many vertical placements being used to mitigate the impact of the hardening market conditions.

The placement process is taking longer as incumbent carriers reduce their lines, and some lead markets delay the quotation stage. Road shows, recent engineering reports, and the ability to demonstrate a commitment to continual improvement to risk management, are crucial to avoid the worst of challenging market conditions.

The market remains challenging with the placement process taking longer as incumbent carriers reduce their lines.

With the continued firming of the market, renewals with a clean loss record and no natural catastrophe (NatCat) exposures have on average experienced 15% to 20% price increases. Accounts that have NatCat exposure, or those that have experienced claims, are generally subject to larger increases, reduced policy coverage, and increased deductible levels.

Due to market exits over the last 12 months, each renewal often starts with reduced capacity, meaning alternative insurers must be considered when designing placement strategies.

Insurers continue to announce that they will phase out participation on insurance programs that include thermal coal-fired power plants with a view to transition away from these assets, the most recent being Lloyd’s of London (refer p. 19). Further announcements are expected to continue into 2021.

COVID-19 continues to have a significant impact on the power market.

Insurers are looking to limit exposure, with the inclusion of specific London Market Association (LMA) clauses on all placements. Plants are taking extensive action to ensure they remain operational, especially throughout maintenance periods.

With on-site risk engineering surveys not as feasible, there is a much higher importance placed on virtual risk engineering. This has generally been well received, and is playing a vital role in many placements.

What was looking to be a positive year for most going into the fourth quarter, has actually resulted in an uptick in large losses, particularly in the US, including another turbulent wildfire season.

Despite a full renewal cycle since significant premium increases began, the trend looks set to continue its momentum into 2021, as results are hampered by the challenging year-end.

Renewable Energy

The fourth quarter in the renewable energy insurance market can be characterized in a similar fashion to those that came before.

In what is an exciting time of significant growth and opportunity for the renewable energy industry at large, London’s onshore and offshore underwriting teams have been stretched by a considerable flow of new business submissions from around the globe.

While the workload has increased for underwriters, internal scrutiny on underwriting performance remains ever-present as insurers look to reverse a number of years of unsatisfactory results. The unwelcome product of this is a difference in terms and conditions and/or pricing across a placement, which has become increasingly commonplace in both the onshore and the offshore market.

As new technologies emerge and develop, the market has tended to tread carefully.

The placement process itself continues to take more time, with lengthy review processes and the increased volume of submissions leading to longer waiting periods for clients.

To achieve the best result, we recommend clients engage their broker at the earliest opportunity ahead of their renewal date. This allows the necessary time to begin the information gathering process, and allows early engagement of the markets.

The level of detail contained in the underwriting submission is more important than ever in achieving optimum treatment from insurers. We continue to recommend engineering reports as a differentiator for all clients, along with pre-renewal virtual roadshows, which are of particular importance for clients with larger asset portfolios.

On a related note, early engagement ahead of the expiration date of construction insurances is also vital. This allows increased time for negotiation and market engagement in a class that continues to be a particular challenge as a result of the shift in underwriting philosophy. During the construction phase, regular reporting and updates are critical to ensure that underwriters have a full understanding of a given project’s progress and subsequent exposure.

On average, minimum rating uplifts to renewal business have continued to stabilize at around 20% to 30%, though larger increases may be experienced on programs with loss activity and/or significant NatCat exposure.

As we look ahead, 2020 and 2019 underwriting performance is likely to dictate whether the market seeks further increases, or if pricing stabilizes after the significant focus on pricing adjustment in 2020. Deductibles continue to be in-line with current market conditions, where minimum self-insured retentions are generally driven by the size of project (or turbine in the case of wind) and NatCat exposure (where relevant).

Placement of projects in NatCat-exposed areas remains a challenge.

Technology has continued to evolve rapidly during 2020 as increasing investment capital enters the industry, and equipment manufacturers grow in experience and technical expertise. As new technologies emerge and develop, the market has tended to tread carefully. As a result, we have seen limited coverage provided for prototypical technologies with exclusions in respect of manufacturing defects for unproven technologies, and/or higher deductibles until the relevant components are tried and tested in a fully operational environment.

Placement of projects in NatCat-exposed areas remains a major challenge, and we have seen pricing for clients with assets in these locations increase dramatically.

Meanwhile, many new projects are impacted by reduced levels of cover in respect of natural perils as the industry continues to expand its global footprint, and owners and developers are forced to enter new, unexplored territories. The emergence of non-traditional NatCat perils such as wildfire, hail, and lightning continue to impact the market.

Positively, we have seen manufacturers react to the challenges around extreme weather, and its impact on renewable energy projects. The emergence of widespread deployment of specific engineering and design methods, which assist in managing the impact of extreme weather events, can greatly assist in obtaining the maximum coverage available. Again, early engagement is crucial to achieve the optimal coverage and pricing results.

Finally, we have seen renewable energy markets continue to focus almost exclusively on wind and solar, meaning capacity from the traditional renewable energy markets for hydro, biomass or biofuels, and geothermal is incredibly limited; indeed many have exited these classes entirely. This is a symptom of poor historical performance coupled with the rapid growth of wind and solar. While coverage for these asset types remains available from the property and power markets, the withdrawal of capacity has led to particular pressure on pricing for these asset classes.

Terrorism

The terrorism market remains a profitable class for insurers, therefore the rating environment for assets in benign areas has hovered around the flat to plus 5% during 2020.

However, there have been significant localized rate increases in parts of the world where the damage to property, often from riots and civil commotion as opposed to terrorism, has been substantial, for example in Chile and Hong Kong.

In parts of the world, damage to property from riots and civil commotion has been substantial.

One of the responses from the insurance market to these losses has been the exclusion of certain strike, riot, and civil commotion (SRCC) perils from property policies, with coverage more widely available under terrorism policies.

Numerous new markets are expected to begin writing political violence and terrorism insurance in 2021, which should have a positive outcome for clients and minimize the likelihood of rate rises.

Energy Casualty Update

Overview

2020 continued the trend for upheaval in the third party liability market.

We are experiencing a hardening market, although it is by no means manifesting evenly across all areas, with most carriers seeking a correction after many consecutive years of reduction, and widening of terms and conditions.

We find ourselves in a hardening market, and it is possible we will see further market contraction.

Although there have not been any market-turning energy liability losses in the past few years, there have been some meaningful claims and incidents arising from the energy and non-energy sector that have resulted in loss making years for many insurers.

Underwriter caution has been accentuated by increasing costs of remediation and clean-up in various jurisdictions, especially the US where ‘social inflation’ has given way to ‘nuclear verdicts’, which even if appealed successfully are exponentially raising defense costs.

It is possible we will see further market contraction in the next two quarters. This is in addition to the numerous markets that exited the liability market in the last 18 months, which has reduced available capacity in London to date by around US $200 million.

Underwriters are under greater pressure to justify every risk that they write, and for that reason market focus continues on areas such as pipeline integrity and risk management, US auto, drones, cyber (no more silence as respects cyber coverage), and wildfire.

Peer review prior to binding, and the multiplying of management sign-off layers, continue to result in a challenging and elongated broking process.

Attitude of buyers

While the long tail nature means it is too early to identify a trend for 2020, there have been instances where clients who buy mega towers – US $750 million and above – and are involved in composite (upstream and downstream) business or have a particularly difficult risk aspect (mining, wildfire, North American pipelines), have been prepared to walk away from purchasing insurance above a certain level.

The rationale of this approach for several buyers has been that the extra limit, above that assessed as prudent for the business and which was bought in the past few years as a result of the low price of capacity (US $1,000- US $3,000 per mile) is no longer cost effective.

Therefore, companies are reverting to previously accepted policy limits and/or reconsidering the limit that required for the business today.

Summary

We find ourselves in a hardening market, and the deepening capacity crunch seems to be gathering pace with options significantly reduced.

Terms and conditions are being reviewed, as are capacity, pricing, and retentions. Early premium estimates are increasingly difficult and unreliable. Starting the placement process early is key; information requirements and short timeframes of previous years are no longer available.

Complete underwriting submissions which include full schedules of assets, turnover, throughput, payroll, employees, maps, and locations of risk are now required for almost all accounts.

Claims experience is being scrutinized more closely, so details of risk management and remediation actions taken to address previous losses can help reduce the likelihood of insurers declining to provide cover.

Ultimately, for the first time in many years, insurers are reconsidering their portfolios and as a result are prepared not to renew accounts if they are not satisfied with the risk profile as well as policy terms, conditions, and pricing.

International Upstream

A very positive few years in this class continued in 2020, and there have been almost no meaningful losses.

Unlike the downstream sector, however, the property part of this class has also run very well, so there is far less pressure on cross-class companies to impose increases on their liability book.

Reductions are highly unlikely as small rises are generally being imposed on this class.

Integrated upstream and downstream accounts are the hardest to place, especially if significant limits are being bought. The pricing patterns follow that of the international downstream/ power/mining/midstream sector.

International Downstream, Power, Mining, Midstream

This has become the most difficult class to place. Many years of depressed pricing, and poor loss experience, have resulted in rate increases.

The wildly varied starting points mean that average premium percentage increases are challenging to predict as many insurers look to correct perceived previous pricing inadequacy on an account-by-account basis.

North American Upstream and Contractors

Excellent loss experience means rates are not increasing significantly.

It is rare to find markets solely exposed to this class, or that do not have other lines of business that have suffered losses (marine, cargo, downstream energy), however, there is tangibly less pressure on this class. US auto continues to concern many insurers, because of some extraordinary court awards and settlements in the past 24 months.

Canadian contractors with cross border exposure are becoming very challenging to place, with some insurers only participating on auto programs in excess of between US/CA $10 million to US/CA $25 million.

Tolerance for “incidental US exposure” on Canadian risks is much lower, and insurers are more likely to decline these risks. Offshore contractors are faring a little better than most, with there being some sympathy for the many players who find themselves at the breakeven point, or below, as Chapter 11 entrants are no longer a rarity.

Latin American business is currently being treated the most harshly; what has historically been a fantastically competitive region is now experiencing extraordinary rate increases, with few alternatives available for clients.

Coverage for force majeure and illegal tapping are a focus of insurers and typically excluded, especially on midstream or transmission risks.

North American Downstream, Power, Mining, Utilities, Midstream

Utilities remain very challenging.

Even though the wildfire losses in California (currently estimated at approximately US $11 billion) mean this coverage is approaching uninsurable, many insurers are re-evaluating their view of US utility accounts in general, irrespective of their exposure to wildfire.

Canadian wildfire is starting to be investigated and capacity withdrawn, though not to the extent experienced for US or Australian wildfire risks.

Bermuda Casualty

The Bermuda casualty market continued to be challenging in the fourth quarter with a continued push on increasing premium levels.

The total capacity being deployed by each insurer is being reviewed, and in many cases reduced. This is being driven by internal management review, comparisons of line sizes of other insurers on the program, and/or desired premium increases not being achieved.

We expect to see a continued tightening, with both premium and limit implications continuing into 2021.

There are some promising signs with new capacity potentially entering the Bermuda market in 2021; we will continue to explore this once capacity becomes available.

Energy Marine Exposure Market Update

Energy Marine Exposures

The worldwide economy has struggled to regain the stability and steady growth that existed before COVID-19. The rolling lockdowns of many key western trading nations, as they have fought to control their respective pandemic problems, have continued to dampen many segments of the maritime sector.

Reduced economic activity, and resultant lower demand for consumer products and raw materials, have prevented the marine industry’s return to an even keel.

Despite decreased shipping activity, there has still been a number of sizeable losses.

Within the marine insurance market, the firming trends established in 2019 continued throughout 2020 as insurers looked to reverse the long-term pattern of unprofitable underwriting results.

The result was a contraction in capacity, insurer closures, and job losses in many regional markets.

International competition between markets has notably diminished, as many regional insurers focus on stabilizing domestic accounts.

The marine cargo market has seen the highest level of increases with average rate rises of 15% to 35%, capacity falling, and some businesses that are looking to purchase high limits struggling to complete their programs.

In the hull market, double-digit rate increases of 10% or more have been maintained throughout the year with clients with hull fleets experiencing some form of increase.

The pricing difference between quality fleets which have a long-term relationship with their insurers and those operators who have less than perfect claims record with a tendency to shift between insurers has widened.

Insurers are willing to walk away from business that does not meet their rating criteria or minimum premium requirements.

2020 was the second year of continued pricing increases, a trend that seems set to continue for the near term.

Despite decreased shipping activity, there has still been a number of sizeable losses that have hampered some insurers return to profitability.

Anticipated increases on upcoming 2021 reinsurance renewals are expected to further strengthen insurers’ resolve to hold firm on pricing and terms, for the time being.

Cyber and communicable disease exclusion clauses are increasingly common, although there is still no adoption of a standard market exclusion clause for communicable disease.

Worldwide, hull market capacity remains more than adequate for most classes of shipping.

New market entrants have replaced much of the capacity that withdrew in 2019/2020. This is expected to help stabilize the market as results improve and an eventual recovery in economic activity takes place in 2021.

Onshore Construction Update

Onshore Construction

The onshore construction market’s dynamics have changed significantly in the last 12-18 months, where we have seen a significant number of insurers/reinsurers exiting this class of business.

Many carriers have placed their construction books into run-off; we estimate almost US $1 billion of capacity has been withdrawn from the market. Despite market moves to increase rating levels, to date we have not seen any major new entrants as the returns are not currently sufficient to attract such capital.

COVID-19 has exacerbated the insurers’ drive to push pricing levels higher, and further coverage restrictions.

A series of high profile power, hydroelectric, and oil/gas project failures have intersected with a number of natural catastrophes, including active hurricane and typhoon seasons, flash floods, and landslides. This has further impacted a market which has experienced a period of continuous decline in rate and numerous construction claims which resulted in significant losses globally.

Such market defining losses have demonstrated that the construction sector is not immune to major events, and consequently several markets have withdrawn from the construction sector altogether.

For others, the major market centers are once again regaining control, and underwriting authority is returning from regional offices to the chief insurance market hubs or insurers’ head offices.

A significant reduction in investment income also caused a further deterioration in the London market results. There has been poor performance by equity and bond portfolios due to rising interest rates in the US, geopolitical uncertainty, and a slowing global economy. This has added to the challenging landscape for major insurance markets to navigate.

The factors above, coupled with the increased cost and limited availability of reinsurance capacity, continue to push the market into a state of transition.

Market conditions have been deteriorating over the course of the last 12-18 months and this will present challenges for insurance buyers. The COVID-19 pandemic has only exacerbated the drive of insurers to push pricing levels higher, and force policy coverage restrictions further.

Through 2020, we saw a rating increase on average of around 10% to 20%.

We saw some reinsurers withdrawing previously offered capacity from the sector, while others withdrew the widest defects covers for oil and gas projects; requiring alternative capacity to be found. This demonstrates a shift from a buyer’s market to a seller’s market.

Extensions of period for existing projects remain difficult on even the best projects, and mid-term replacement of markets in run-off remains a protracted or, for some projects, impossible task.

The outlook for London is more of the same – a steady increase in rates and deductibles (albeit possibly at a slowing rate of increase), and a heightened awareness by construction underwriters that ‘Black Swan’ events do occur within the class of business and impact underwriting results.

Elsewhere, North American, Latin American, Middle Eastern, and Asian markets have lagged behind London’s rate of change during the past 18 months. This, coupled with the return of decision making to principal market centers, should result in a narrowing of the gap around adequacy of underwriting and in the difference of terms between the global hubs and London.

The focus on defects coverage and natural hazard exposures continues.

Regional Market Update

Latin America

Capacity for the power business has remained relatively stable despite additional insurer office closures in 2020.

With approximately US $500 million of working capacity available, Latin American markets can write quota-share and non-proportional placements, which suits the majority of accounts and limits within the region.

There is pressure on reinsurers to balance rates, while at the same there is a certain level of opportunism.

A key factor in 2020 was the crucial role played by managing general agents (MGAs), who provided capacity for large and complex risks. MGA’s mainly participate in short primary lines of business with high premium rates, or on the upper lines of an insurance placement where the risk of loss is lower.

Capacity for energy programs is not as robust in Latin America, and is still mainly dependent on the international hubs. For this reason, the market follows global trends, with high rate increases in downstream and lower rate increases in midstream and upstream businesses.

Generally, reinsurance prices have continued to trend upwards. When a reinsurer underwrites one risk from the region, it is not looking at the risk in isolation, but considering its global portfolio and catastrophic exposure.

2020 has proven to be a relatively benign season in the Caribbean, however, this was not the case for the continental Americas with multiple hurricanes impacting the US Gulf Coast, fires in California, and recent severe hurricanes in Central America.

The fact that underwriting teams are connected, and portfolio terms and results are shared, means underwriters are under pressure to ensure that same base rates apply to similar assets regardless of their location (for example in Latin America and in Europe). Risks with similarities are monitored and cross-checked for rating consistency. There is pressure on reinsurers to balance rates, considered below underwriting guidelines, while at the same time there is a certain level of opportunism.

Signals are that reinsurance rates will continue trending upwards, and capacity will be more restrictive, and carefully deployed.

Many markets rely heavily on retrocessions to provide capacity for large lines, in particular for NatCat exposed areas. Retrocession cost has generally experienced double digit increases, contributing significantly to the overall price.

The market signals are that reinsurance rates will continue trending upwards, and capacity will be more restrictive, and carefully deployed on certain risks and coverages. Sub limits, for example, often have not been considered for some time, resulting in some large exposures; it is expected that Latin American markets will pay particular attention to not only price and deductibles, but also overall exposures and the applicable sub limits.

Other policy conditions – such as non-claim bonus, long-term agreements, or even 18-month policy periods – have been a challenge to obtain or are not available. Some markets are also looking to include business interruption caps, or introduce business interruption volatility clauses to limit coverage for this exposure.

Without regular business interruption declarations, markets will look to mitigate the seasonality of the exposure and are looking to introduce caps per month and on an annual basis.

This current insurance environment has also seen the introduction of different versions of pandemic exclusions, cyber exclusions, and the exclusion of strikes, riots, and civil commotions (SRCC) exposure. For SRCC, following a series of unexpected losses, insurers are looking to apply a total exclusion, with coverage then purchased in the specialized market.

2020 put clients under more pressure to find efficiencies in their insurance programs. Options to reduce limits, increase deductibles, or even include a self-insured retention has become increasingly common.

In the context of changing market conditions, companies need to ensure they purchase adequate insurance limits to cover their estimated maximum losses, and deductibles that protect the cash flow and their bottom line. The analyses of risk appetite, and the early discussions with insurers to obtain a balanced result, has been challenging.

2020 put clients under more pressure to find efficiencies in their insurance programs.

As experienced globally, Latin America moved quickly to virtual interactions in response to COVID-19, including for client roadshows. This has generally been well received by the local markets where a larger number of participants have had the opportunity to participate.

Although the majority of the Latin American market and decision makers (particularly for the power sector) are based in Miami, there are key markets and engineering teams in the region that have been able take part in client presentations.

The virtual connection does not fully replace face-to-face contact and the value of in-person conversation, this year clients have sought to capitalize on the strength of existing personal relationships as well as the introduction of new techniques for client meetings, group forums, one-to-ones, and even deep dive inspections with engineers.

The crucial factors, given the market context, for achieving the best results are the quality of the information and allowing sufficient time for a full analysis. Information on maintenance during COVID-19 has been a high priority, as well as information on risk management and loss control.

The new normal means that underwriters require internal referrals, modelling, and peer reviews before they provide their quotation, and in many cases, there is in-depth negotiation before the final agreed terms are reached.

Middle East

Against a backdrop of increased global volatility, it is not surprising that the Middle East market has seen further changes in its profile.

Despite these changes, the region’s mix of carriers, and its breadth of products, means it continues to be a credible marketplace for many buyers.

The focus of the reinsurance markets in the Middle East, centered in Dubai, remain the specialty classes of energy, power, construction and financial lines.

The impact of the shifts in the international markets has caused a reduction in the number of viable leaders.

Global changes in these sectors continue to force the large corporate insurers to realign their international investments and, following the decision of a carrier in the first quarter of 2020, we have seen another large international carrier close its Dubai branch office at the end of 2020. Despite the departure of a few global players in the last 18 months, the Dubai International Financial Center (DIFC) remains the home of a number of global insurers/reinsurers.

The impact of the recent changes to buyers is difficult to quantify, although we would comment positively on the continuation of relationships offered to some buyers when underwriting has switched back to London. Other carriers have approached the situation differently keeping their branch offices open, while relocating certain classes of business including energy, power, and construction back to global hubs.

There is no doubt that, from an international market standpoint, the Middle East is on a low ebb, but there are positive signs from other markets – both well-established and newer market entrants – with underwriting teams expanding and, in some instances, the Dubai hub taking on underwriting responsibility for their London and European teams.

The impact of the shifts in the international markets has caused a reduction in the number of viable leaders – especially in downstream energy and power. Conversely, those leaders that remain are more consistent in their approach than their peers.

We have seen a growing appetite from local insurers to increase their net and treaty positions on downstream risks.

One of the defining features of the Middle East market continues to be the vibrant mix of carriers, and while the international markets are important, it’s the locally-based carriers and MGAs that give the region its profile.

In these areas, we have also seen some changes – there are shifting appetites within the sub-sectors with the internationally-focused arms of the established cedants taking more conservative positions on energy risks.

Conversely, we have seen growing appetite from some Abu Dhabi based cedants for international risks, when traditionally they focused on domestic business.

Added to this positive trend is the credibility of the MGAs who, despite challenges, have prevailed with growing capacities or new underwriting teams, showing them to be more robust than many thought.

In some instances, we have also witnessed a growing appetite from local insurers to increase their net and treaty positions on downstream risks in view of the general improvement in terms, and the continuing support from their established treaty reinsurers.

We are optimistic that 2021 will offer more opportunities for stabilization.

2020 has been a year of unprecedented challenges, and yet in many areas we have witnessed a reduction in the level of price volatility for regional buyers.

While the Middle East market is in line with global market trends, which continue to push pricing up for most sectors, there are signs that the proliferation of insurer opinion on pricing and coverage, witnessed in 2019, can be drawn closer together through an inclusive, consensus-based approach to marketing insurance programs.

We are optimistic that 2021 will offer more opportunities for stabilization, and are confident the regional markets in the Middle East will have an important part to play.

Asia

Downstream

The Asia downstream market tends to react more slowly to changes in market dynamics, certainly compared to London, and that was once again the case with the initial and sustained rate movement currently being experience, which only began locally towards the end of 2019.

Historically we have not seen the significant loss profiles in Asia that are experienced elsewhere globally, and the market traded on the back of this factor as a way of rationalizing premium, and rating levels that in the main have been lower than most other territories.

However, at the start of 2020, the market in Asia started to respond more forcefully, with rate increases applied across the board.

Some of the percentage increases have been sizeable but these are also being applied to rates which are starting at a lower base than would usually be the case (elsewhere in the world), as such the premium pools and renewal rates applied are often competitive and remain challenging for London markets to support.

The Asia capacity pool, in excess of US $2 billion, has meant that the majority of downstream operations remain (re)insured in the Asian market, with only the larger operations generally requiring London and/or global market support. In addition, within Asia the combination of both international carriers and more indigenous regional carriers offering capacity are reasons why there has been a more competitive premium environment historically.

While Singapore remains the hub, there are also pockets of capacity offered from several other territories, which combine to increase the levels of available capacity in the region.

However, this year we have seen a sea change in the Asia market.

Significant losses have hit the region during 2020; regional and head office management of the underwriters are reacting by questioning historic premium rates, and taking immediate steps to change tack as they seek to bring their Asia portfolios rating in line with the rest of the world.

In addition, the balance in underwriters’ portfolios is being reviewed, with subsequent steps often involving reduced lines and/or a more cautious approach to natural catastrophe elements of risk.

There is a particular focus on business interruption exposures, and the increasing percentage of overall claims settlements which are attributable to business interruption. Silent cyber exposures, and the approach to COVID-19 (and general pandemic factors) is aligned to the London marketplace.

Despite these market dynamics, we still see the Asia market offering attractive capacity to regional clients. Markets in the region benefit from a closer relationship and understanding of the Asian risk environment specifically, and this allows underwriters to take a more pragmatic and supportive approach with regional clients.

Traditionally the Asia energy market has been consistently profitable, so while 2020 presented challenges, and we have seen premium corrections, the rating base remains commercially driven and reflective of the region’s past profitability.

Outside of the property and business interruption covers, we are seeing developments in the Asia liability market sector as well, with premium rates correcting; reflecting in part the loss experience seen in the region, as well as concerns for an increasingly litigious environment in Asia.

As with the property related sector, Asian energy clients have in the past benefitted from both wider cover and more commercially-driven premiums than available elsewhere in the global marketplace. (Re)Insurers are still looking to support their insureds, but only where they consider the pricing levels to be acceptable and in-line with the more liability prone environment.

As such, current market conditions will likely continue through 2021 – with strict underwriting discipline enforced, and underwriters moving closer to what they consider their technical price.

Upstream

The upstream market in Asia has followed the example set by their peers in London in seeking some form of rate increases and/or coverage restrictions across their respective portfolios.

In terms of leadership in the region, the usual players have been stepping up on both operational and construction business. That said, the panel of leaders in Asia does seem to be shrinking and overall capacity has somewhat reduced with some Lloyd’s markets moving authority for their energy accounts back to London.

Across the upstream market in Asia, we have seen underwriters remain steadfast, maintaining minimum single digit rate rises on clean operational renewal business.

Liabilities have been more volatile with up to 50% to 60% rate increases generally experienced, and higher retentions.

It is increasingly common that, where possible, credits such as prompt pay discounts, renewal incentive bonuses, and no claims bonuses achieved in softer market conditions, are being removed as underwriters focus more on their acquisition costs.

There is also a tougher stance from markets with regard to requests such as extension of quote validity periods, period extensions, and premium payment terms. Lead markets are now issuing notices of cancellation should they not receive premium in the stipulated timeframe. Achieving contract/period extensions is also challenging, with underwriters now reticent to offer extensions at pro rata rates.

The change in market appetite has been more prevalent in the offshore construction arena, with some carriers now having an aversion for writing pure subsea risks, and some pulling out of the class altogether.

While deductibles show a level of consistency, ratings have increased when compared to 18 months ago, with small projects quoted at around 1.5% net and larger projects at approximately 1.0%.

The Asia region can still be a competitive area for construction liability with certain lead markets, but often there is a disparity in pricing.

Power

Power clients in Asia have also faced one of the most challenging insurance markets for decades.

When the market began hardening in 2018, the impacts on Asian clients were relatively modest when compared to other regions. This changed in 2020 as local underwriters gained more confidence in their ability to request, and achieve, the increases required by their management.

There was a drive by insurers to achieve technical pricing, and a focus on offering smaller line sizes to reduce aggregation exposures. This was coupled with a tightening facultative reinsurance market, which reduced the ability of insurers to reduce and/or offload any unwanted exposures.

Clients with challenging risk profiles, or natural catastrophe exposures, were impacted more significantly.

The market also reacted swiftly to insureds with losses, in certain cases imposing triple digit increases and often restricting coverage by higher deductibles or lower sub limits in an attempt to recoup the losses instantly.

The Asia market is expected to harden again in 2021 given the performance of the insurance market in 2020.

The major contributor to this will be COVID-19, but power clients in the region have also suffered a number of large losses that will continue to bring focus on underwriting performance. The level of increases should begin to moderate, otherwise insurers risk a withdrawal of premium as clients look to alternative mechanisms to transfer risk.

As the market continues its current state, insurers are expected to change their focus from pricing increases to coverage restrictions.

New Products & Developments

OGA Interactive Map

The UK Oil and Gas Authority (OGA) has worked with The Crown Estate (TCE) and Crown Estate Scotland (CES) to create a new interactive mapping app that reveals the location of every energy-related site in the UK Continental Shelf (UKCS).

Described by the OGA as game changing, the app is expected to bring real benefits for exploration and the search for carbon storage locations.

The app lists over 60 in-construction or active wind, wave, and tidal sites on the UKCS, as well as recently awarded CCS licenses, and 489 petroleum licenses.

It is automatically updated as new information is logged, and marks the first time that the locations of all oil, gas, and renewables sites have been presented together.

OGA Well Decommissioning

The UK Oil and Gas Authority (OGA) has launched one centralized location for well data related to decommissioning. The data, which is already publicly available, has been consolidated for the first time to help raise awareness about suspended wells in the UKCS that are awaiting decommissioning.

The organization said the data will allow the supply chain, and operators, to identify wells that would be suitable for decommissioning through a campaign approach, aggregating individual projects together into a larger program of work.

Campaign-based well decommissioning projects, as opposed to decommissioning wells individually, can result in substantial cost savings, especially when multiple operators engage together, the OGA noted.

A culture shift to campaign-based decommissioning has the potential to significantly reduce the cost of decommissioning overall, according to the OGA.

Political Violence

Political Violence

In this regular feature, we look at common clauses found in energy insurance that are often not well understood, consider what their intentions are, and what they cover or exclude.

Many readers will have heard of political violence coverage, but what does it mean and what are the perils covered?

Political violence is essentially an expanded terrorism policy.

While terrorism coverage is often bought within a property ‘all risks’ policy, political violence insurance is generally written as a standalone policy by specialist insurers.

What are the additional coverages in a political violence policy?

Terrorism insurance typically provides coverage for the resultant physical damage (and business interruption if purchased) from acts that are motivated by politics, religion, or ideology, often including sabotage for the same motivation.

Political violence policies typically include such acts of terrorism, but also provide coverage related to war, civil war, revolution, rebellion, mutiny, insurrection, coup d’état, strikes, riots, civil commotions, sabotage, malicious damage, and consequential looting.

One of the benefits of purchasing a political violence policy is that it eliminates the potential dispute inherent with a standard terrorism policy when a terrorism type event occurs that appears to be backed by a government – and it is unclear whether the act is in fact terrorism or war.

An example of this is the 2019 drone attacks on Saudi oil facilities. If, as the Saudi government referenced, the attacks were an act of ’terrorist aggression’, or if the attack came from Houthi rebels in Yemen (as they claimed), a standard terrorism policy should have responded.

However if, as the US claimed, the attack came from Iran, then that is likely to be excluded by any war exclusion which generally excludes “war…acts of foreign enemies, hostilities (whether war be declared or not)…” and would only be covered if a political violence policy was purchased.

The above is provided as a general overview of some of the coverage often provided by the aforementioned clauses. This is not intended to be an extensive and exhaustive analysis of the insurance coverage provided by such clauses. The comments above are the opinion of Marsh JLT Specialty only and should not be relied on as a definitive or legal interpretation. We would encourage you to read the terms and conditions of your particular policy and seek professional advice if in any doubt.

Common Clauses: Political Violence

Common Clauses: Political Violence

Proin et est sed nunc ornare vehicula ut eu sem. Donec egestas elementum leo. Phasellus urna mi, viverra nec eleifend eget, interdum sit amet nisi. Sed tempus nunc quam, ut semper arcu convallis et. Nulla condimentum ut tellus nec porttitor.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer tempus commodo magna, eu accumsan urna molestie eu. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Praesent sollicitudin arcu sed libero euismod, a ultricies ligula molestie. Sed quis suscipit justo, ac laoreet diam. Cras non eros vestibulum, condimentum elit finibus, vestibulum enim.

Morbi tincidunt massa ipsum, eu viverra enim tempus ut. Nam mattis sem id eros porttitor, id imperdiet enim tempus. Mauris nec mi tincidunt, imperdiet nisi vel, posuere nisl. Maecenas nec ipsum quis purus feugiat commodo. Cras non viverra neque. Maecenas lobortis purus ipsum, id maximus tellus tincidunt quis.

Heading 3

Morbi condimentum placerat lorem, et cursus ligula fringilla id. Nunc sit amet sapien eu magna tristique molestie ac laoreet libero. Nulla aliquet, metus sit amet ultrices laoreet, tortor tellus eleifend odio, sit amet molestie elit nisi non lectus. Vivamus hendrerit non felis sit amet varius. Phasellus eu arcu quis odio aliquet egestas in ac turpis. Curabitur risus risus, tincidunt eu tellus varius, porta fringilla mauris. Aenean blandit velit lacus, non dapibus massa vestibulum at.

Fusce commodo tempor neque, consectetur luctus sem bibendum a. Duis fringilla viverra quam, in auctor felis sollicitudin ut. Donec finibus lectus at ultricies suscipit. Donec egestas risus ac lectus elementum convallis.

Heading 3

Quisque ut nunc est. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; In vel mauris non ante fringilla tincidunt. Nullam tristique quam ut sapien finibus, at tempus libero volutpat. Proin et est sed nunc ornare vehicula ut eu sem. Donec egestas elementum leo. Phasellus urna mi, viverra nec eleifend eget, interdum sit amet nisi. Sed tempus nunc quam, ut semper arcu convallis et. Nulla condimentum ut tellus nec porttitor.

Atlantic Named Windstorm

Windstorm Update

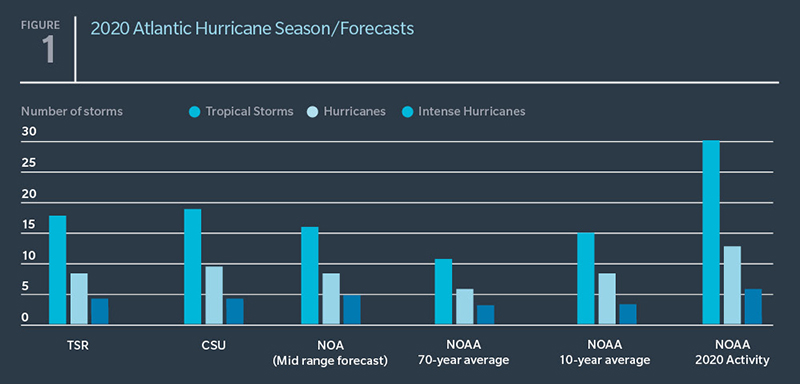

The 2020 Atlantic hurricane season officially ended on December 1.

The chart below plots the season’s activity against forecasts from Tropical Storm Risk (TSR), the National Oceanic and Atmospheric Administration (NOAA), Colorado State University (CSU), as well as the 70- and 10-year averages.

On November 24, 2020, NOAA said the 2020 Atlantic hurricane season set multiple records while producing a record 30 named storms.

The season also saw the second-highest number of hurricanes on record; 13 of the named storms reached hurricane status.

There were six major hurricanes with top winds of 111 mph (178 kph) or greater.

In the same press release, NOAA said an average season has 12 named storms, six hurricanes of which three become major hurricanes.

This season also set a record for the number of storms that made landfall in the continental US with 12 named storms. Of those, six made landfall at hurricane strength, tying the record set in 1886 and 1985.

NOAA said this was the fifth consecutive year with an above-normal Atlantic hurricane season, with 18 above-normal seasons out of the past 26.

2021 Forecasts

TSR predicts North Atlantic hurricane activity in 2021 will be above the long-term norm, but lower than the hyperactive 2020 hurricane season. However, uncertainties associated with this outlook are large and the forecast skill at this extended range is historically low.

TSR’s extended range forecast for North Atlantic hurricane activity in 2021 anticipates a season with activity approximately 20% above the long-term norm, and close to the 2011-2020 10-year norm level.

TSR’s main predictor at this extended lead (6 months before the hurricane season starts) is the forecast July-September trade wind speed over the Caribbean Sea and tropical North Atlantic.

This parameter influences cyclonic vorticity (the spinning up of storms) and vertical wind shear in the main hurricane track region.

At present TSR anticipates that the July-September 2021 trade wind speed will be slightly weaker than normal – due mainly to the expectation for weak La Niña conditions to occur at this time – and therefore the expectation is an enhancing effect on North Atlantic hurricane activity in 2021.

TSR has stated that its real-time December outlook for the upcoming North Atlantic hurricane activity between 1980 and 2020 is low.

Finally, TSR is predicting 16 tropical storms in 2021, seven of which will become hurricanes, of which three are predicted to become intense hurricanes (category 3 and above).

Claims Update

US Definition of Seaman

We have previously reported on the decision from the US Court of Appeals for the Fifth Circuit concerning the test for seaman’s status. The case involved a land-based welder who worked aboard a jack-up drilling rig next to an inland pier and who the district court determined was not a seaman. On appeal, the Fifth Circuit held that the welder was a seaman based on precedent within the circuit.

This case will prove to be significant, as it may limit seaman status to individuals that are exposed to the perils of sea

However, in the concurring opinion, the Circuit Judge stated that the Fifth Circuit’s precedent did not correctly apply the US Supreme Court’s authority and urged the court to rehear the case en banc to clarify inconsistencies between Fifth Circuit precedent and that of the Supreme Court. The Fifth Circuit has now ordered that this case be reheard by the court en banc with oral argument.

In law, an en banc session (French for "in bench") is a session in which a case is heard before all the judges of a court (before the entire bench) rather than by one judge or a panel of judges selected from them.

This case will prove to be significant, as it may limit seaman status to individuals that are exposed to the perils of sea by regularly working aboard vessels that sail. The significance of being classed a seaman is that it allows a suit to be brought under The Jones Act, which allows for much higher settlements than those available under workers’ compensation laws available to workers other than seamen.

Engineering Update

Engineering Update

As t the start of a new year, we reflect on the unprecedented disruption for our clients during 2020, and the difficulties that the risk engineering community has faced in providing indispensable underwriting information to support the insurance placement process.

This virtual capability is a valuable addition to the risk engineering toolbox

With an innovation mindset, Marsh JLT Specialty risk engineers, together with colleagues from the insurance markets, safely conducted over 450 virtual inspection survey activities during 2020. We also piloted a technology solution that further enhances the field-inspection element of these surveys through utilization of augmented reality (AR) headsets to livestream video and audio content from an on-site host engineer.

The technology, which enables risk engineers to view a site remotely via laptop or mobile device, also has the following advantages:

- Already in use by a number of large energy and power companies.

- Intrinsically safe for the host engineer.

- Allows safe, hands-free operation.

- Enables helmet mounting of the camera, which does not impair a user’s vision.

- Supported by all major video feed applications such as Zoom, Microsoft Teams, and Cisco WebEx.

The technology has been used with a number of Marsh JLT Specialty clients throughout North America, Europe, and the Middle East; further trials are continuing in other regions.

Feedback from both clients and market risk engineers has been very encouraging, and this virtual capability is a valuable addition to the risk engineering toolbox.

We will continue to engage with clients and markets about the lessons learned, and the best ways to incorporate these tools and methods into our service framework of the future.

In the fourth quarter, we also extended our risk engineering offering to clients in the power sector by launching a new suite of deep dive services.

These analytical reports are designed to provide clients with an in-depth understanding of risk quality, and considered risk improvement advice tailored to power generation companies across both conventional and renewable segments.

We have recently completed deep dive reviews across a number of key focus areas, including:

- Emergency systems (emergency power systems).

- Asset integrity management (electrical machines).

- Management of technical information letters (TILs).

- Process safety management.

- Emergency systems (plant safety systems and contingency planning).

Disruption to business-as-usual is difficult. However, the technological advances and achievements noted above demonstrate the resilience and focus of our colleagues, clients, and industry associates and, reinforce that innovation is sometimes as simple as being able to adapt quickly.

Claims Update

Claims Update

2020 has without doubt been an extraordinary year for many reasons.

Some events, such as the COVID-19 pandemic, will live long in our memories, and will potentially change the way in which we all live and work.

The pandemic and other events also will have a notable impact on how claims are brought, managed, and recovered within the energy and power insurance markets.

The Financial Conduct Authority (FCA) brought a test case in the UK High Court to determine if certain UK property damage/ business interruption insurance policies should respond to COVID-19 claims. The High Court found for insureds on a number of the issues.

Certain insurers have now elected to pay as valid claims while other have filed an appeal. We have not seen many energy or power claims submitted as a direct impact of COVID-19, probably due to the policy language or small sub-limited extensions.

What we have seen is an impact on existing claims, where there have been delays in reinstatement of damage due to quarantine restrictions on workforce and delays in obtaining replacement equipment. It remains to be seen whether insurers will take a pragmatic or hardline approach to such issues, like the public authority extension time limit.

The markets also lived through the seesaw pricing of crude oil, at a time when demand for product fell significantly due in part to worldwide quarantine restrictions. For more than three quarters of 2020, the world mostly stopped flying, and significantly reduced driving their cars.

While many businesses saw a significant reduction in expenses, there was also a major impact on growth plans, capex investments, and maintenance regimes.

On existing claims, we saw some unusual patterns where margins and losses were larger than expected in the initial lockdown period. This was primarily due to low crude prices and high demand as customers took advantage by stockpiling finished product.

We also witnessed another record hurricane season in the Gulf of Mexico and US, highlighting the change in global weather patterns. The onshore energy market continued to see some significant market losses during the year, which has reinforced the increase in premium rates and stricter insurer policy interpretation of claims issues.

Delivering Value During the Pandemic

To November 2020, our specialist Energy & Power claims team had collected and paid over US $1.5 billion to clients around the world.

This compares to average yearly settlements of around US $1.25 billion over the previous four years. In 2020 the team managed nearly 2,000 new claims, and over 8,000 claims transactions.

There are some notable individual claim outcomes worth mentioning.

We successfully negotiated one of the largest, most complex energy claims ever seen in the market. We engaged the breadth of Marsh’s global experience and expertise, including claims preparation and advocacy, to drive an optimal final settlement of in excess of US $1 billion for our client.

COVID-19 restrictions meant that final settlement meetings were held virtually with participants from several countries using multiple zoom breakout rooms, while in lockdown.

Despite lockdown restrictions, our claims advocates were able to deliver a speedy final settlement of over US $300 million for a client.

Again, Marsh JLT Specialty leveraged its global claims capabilities available to present the final claim, and avoid insurers delaying a final resolution until after lockdown. Zoom and Microsoft Teams were used to present and negotiate the final settlement, with multiple parties and countries being involved.

On the above claims, we were engaged to provide optional claims advocacy service in addition to our general service offering.

The claims preparation team was engaged to project manage the claims resolution to ensure all parties were aligned with the agreed strategy and the best outcome was achieved.

It has been reported* that London market based insurers have seen a double-digit percentage improvement in the payment of claims during lockdown.

However, our operational review seems to point to a downturn of overall claims volumes in 2020 due to the pandemic.

While the market appears to have used this opportunity to finalize numerous small value, straightforward claims, and close off some older outstanding claims, we believe there is still opportunity to challenge the market to find new and improved ways to provide the best claims solutions for clients.

* Insurance Insider, December 3, 2020.

Download

Subscribe to Updates

Download

Download

Click or tap the download icon to receive your complimentary PDF copy of this edition.

And be sure to subscribe to receive future Energy & Power updates.