Food for Thought- September 2019

Alternative Risk Finance Whetting Appetite of Food and Beverage Companies

After several consecutive quarters of downward pricing, record catastrophe losses in 2017 and 2018 have turned the tide on property insurance costs, and food and beverage companies have been feeling the pinch.

Hurricanes, earthquakes, and wildfires turned 2017 into the worst disaster year on record, with insured catastrophe losses hitting $150 billion. This was seen as a wake-up call for insurers, but the challenges only grew. Insurance prices, which had fallen for several years, were still largely inadequate to fund the more than $80 billion in insured catastrophe losses suffered in 2018.

The message from insurers following these two consecutive years of losses was clear: Relaxed underwriting standards and pricing flexibility, which had become more or less the norm, were due to change. And as these shifts started taking place, food and beverage companies have had to face a new reality: Higher insurance prices.

To complicate matters, some insurers have decided to no longer underwrite the food and beverage industry, especially protein processors, leading to a notable decline in capacity available to these businesses. And even those companies that are not facing this challenge are seeing increasing premium costs, accompanied by more stringent underwriting. Many food and beverage companies are also being forced to take on higher

retentions due to the nature of their risk and the prospect of unknown events – like a disease affecting their livestock or problems with shipping perishable products – that can severely affect their bottom line. All this is leading these companies to evaluate their existing insurance portfolios and consider alternative ways to finance their risks.

Alternative Solutions Gaining Traction

According to data from Guy Carpenter, alternative capital has been on an upward swing. Available alternative capital grew by around 9% in 2018, reaching $95 billion at the end of the year. This growth followed a 16% increase in 2017. Private equity funds, sovereign wealth funds, hedge funds, pension funds, and other capital owners have reportedly earmarked an estimated $1 trillion for investment in risk finance.

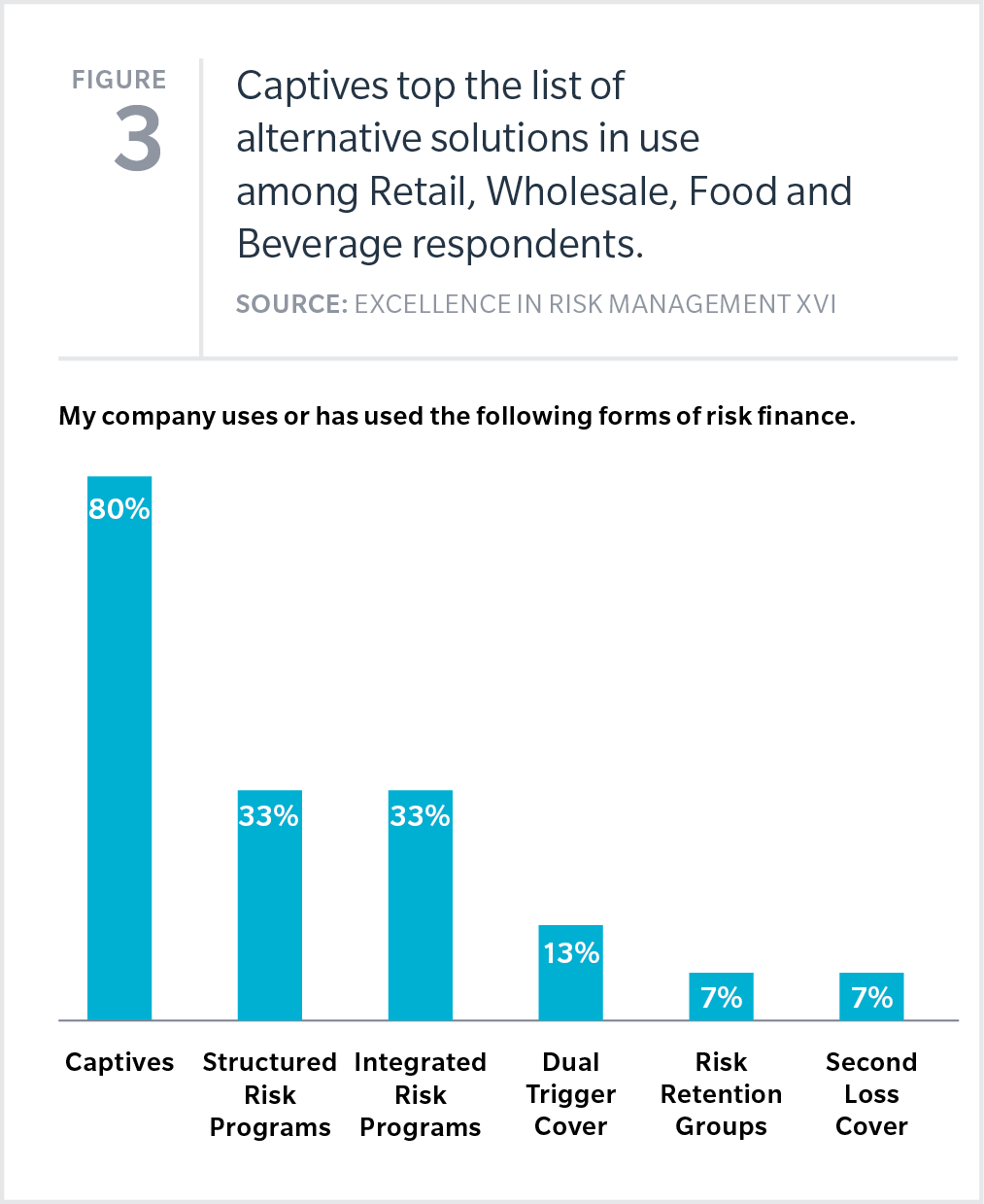

As available alternative capital has increased, so has interest in alternative risk transfer (ART) solutions. And changing underwriting practices are driving some food and beverage companies to recognize the potential benefits offered by alternative insurance solutions. Almost a quarter of retail, wholesale, food, and beverage (RWFB) respondents to the 2019 Excellence in Risk Management survey said they either use or have used alternative risk transfer solutions. Another 6% said they’ve done their research and expect to access alternative solutions within two years (Figure 1).

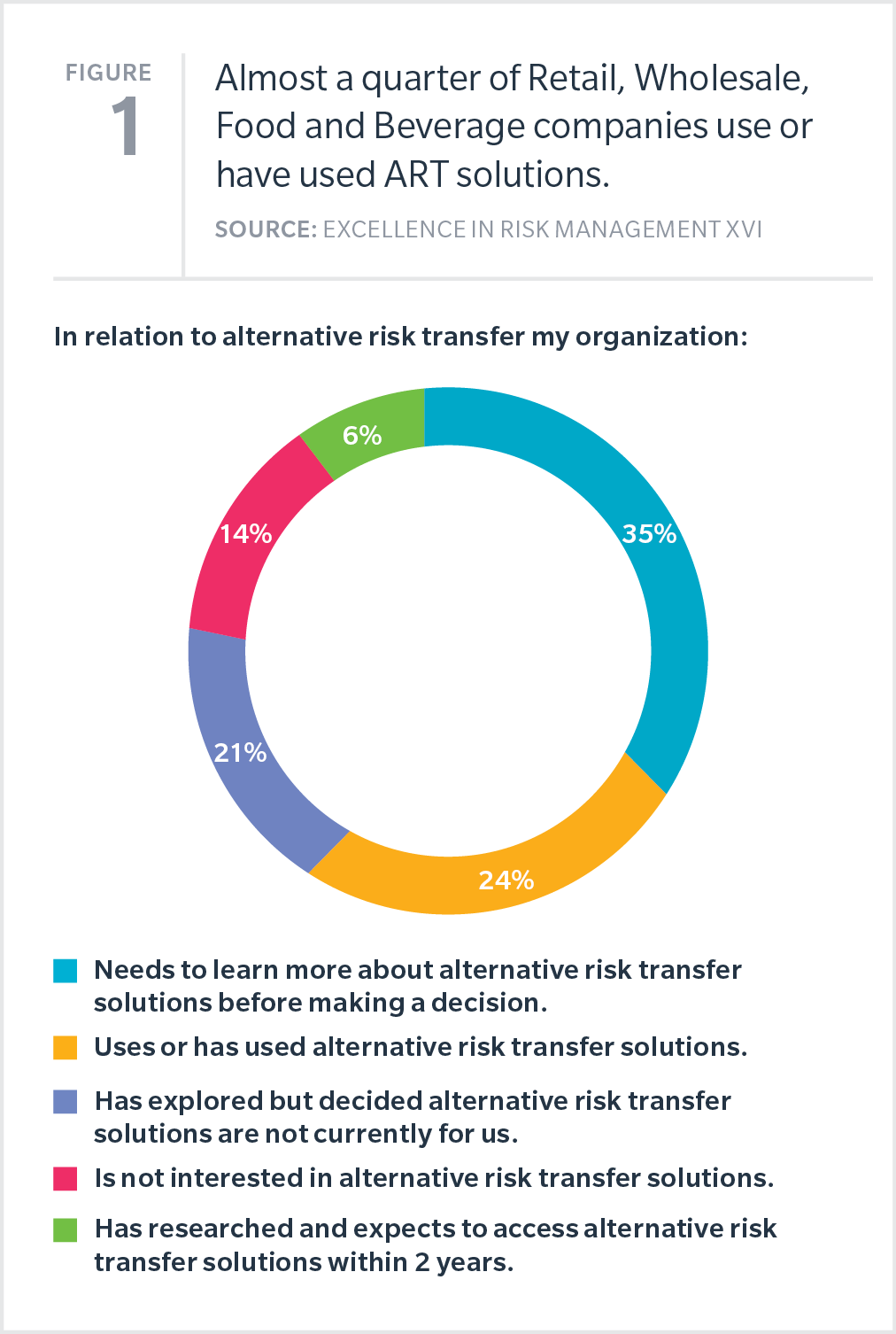

Managing property and casualty risk and financing hard-to-insure exposures are the main areas RWFB respondents believe they could use alternative solutions (Figure 2).

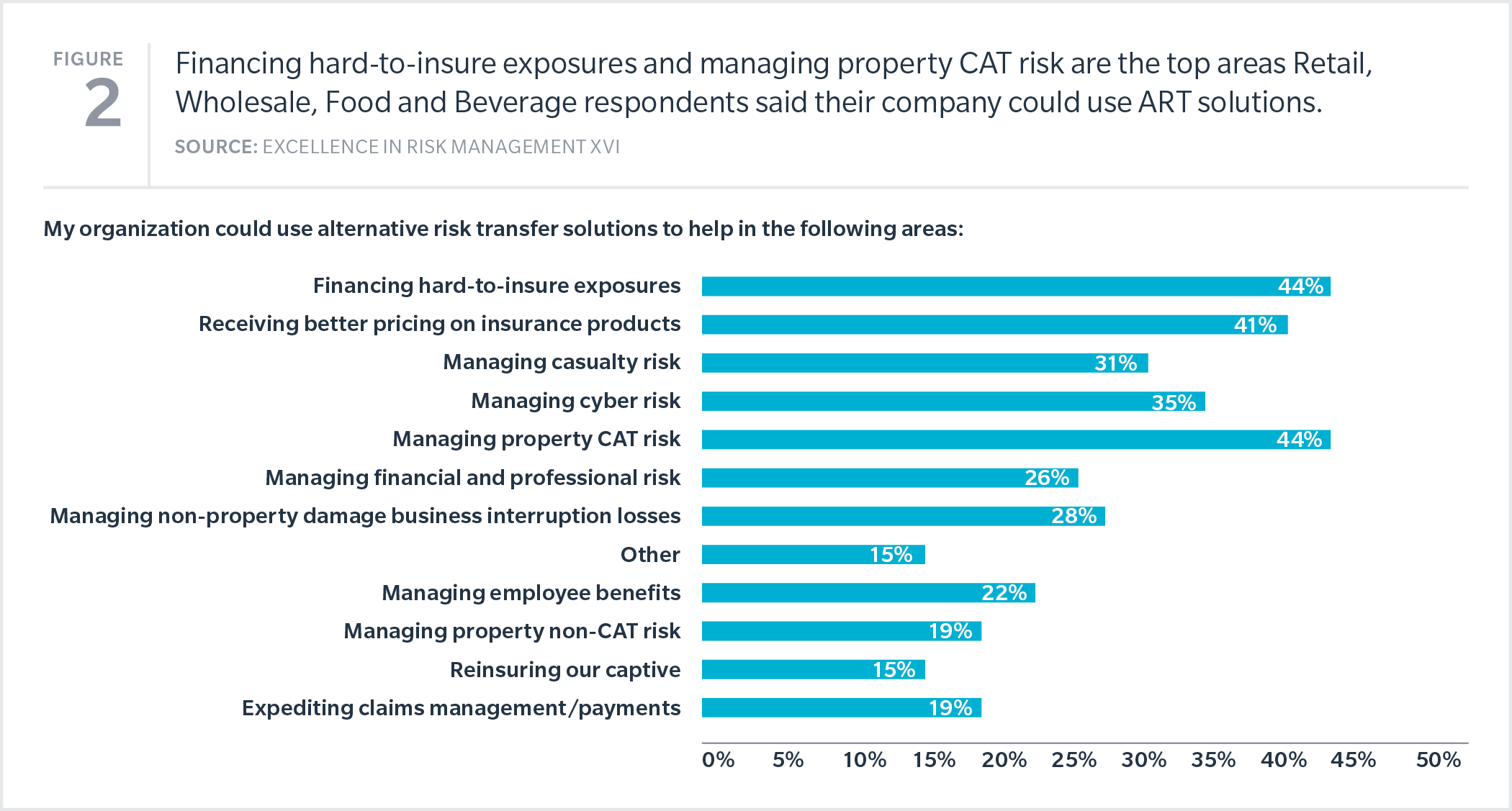

A notable 80% of industry respondents whose companies use or have used ART solutions said they use a captive. This was by far the most popular option, followed by structured and integrated risk programs (Figure 3). However, none of the industry respondents said they use parametric solutions, which could be a good option to solve for a specific catastrophe problem.

Alternative solutions tend to be more common among larger companies, which see these products as a way to finance their risk more efficiently. These solutions can also help reduce volatility and create opportunities for risk management diversification.

There are, however, some obstacles to using alternative solutions. Difficulty explaining the benefits of alternative solutions to others within their organization was a challenge cited by 37% of industry respondents, while cost was named as an obstacle by 33% of RWFB respondents.

Tapping into the Marine Market

Food and beverage companies tend to hold substantial levels of inventory, and since the mid-1980s have been increasingly seeking stock throughput (STP) policies to cover their stock. Although technically a marine policy, STP has been increasing in popularity among organizations that want to insure their inventory throughout its lifecycle, whether in transit or in storage.

While food and beverage companies have been using STP policies for a few decades, they have recently started gaining more traction as insureds began experiencing increases in their property premiums. Although STP premium costs have also increased recently, these solutions still tend to be less expensive than property insurance. And while higher prices are leading to buyers reevaluating their current STP policies to make sure that they provided the most efficient coverage for their inventory, in most cases they are finding that it is their best option. STP policies also:

- Typically provide enhanced coverage and can help avoid interruptions in coverage. Traditionally, companies that held high levels of inventory would need a property policy to cover their inventory while it was at distribution centers or in storage, switching to a cargo policy while the same inventory was in transit, and then going back to a property policy when it reached its destination. Not only did this process require additional and time-consuming paperwork, this approach can also carry risks of errors leaving gaps in coverage. Since an STP solution typically covers the inventory itself, irrespective of its location, it eliminates a potentially expensive problem. • Generally allow for lower deductibles, which usually come in the form of a fixed dollar amount rather than a percentage of insured assets. This makes it easier for food and beverage companies to plan ahead to finance that cost.

- Tend to have a more streamlined claims process due to a simplified evaluation. This means that, in most cases, buyers can get their insurance payouts more quickly than with other policies, meaning they can start to rebuild faster.

Although larger companies with strong balance sheets and the ability to make substantial initial capital investments tend to be more likely to purchase sophisticated alternative products, like event-based triggers, STP solutions can be a fit even for smaller firms, and could lead to the benefits outlined above. However, it is imperative that all organizations interested in STP solutions start doing their due diligence well before a renewal date; although STP policies typically require the same data and information that would normally be requested by a property underwriter, it can take time to establish such a solution as part of a company’s overall insurance portfolio.